The Impact of Macroeconomic Factors on Stock Market Performance: Perspectives from Korea Financial News (Investment & Securities)

The Impact of Macroeconomic Factors on Stock Market Performance: Perspectives from Korea Financial News (Investment & Securities)

Introduction

Understanding the relationship between macroeconomic factors and stock market performance is crucial for investors and traders. Numerous studies have been conducted to explore this connection, and Korea Financial News (Investment & Securities) provides valuable insights into the impact of macroeconomic factors on the Korean stock market. In this article, we delve into the key findings and offer a comprehensive analysis of the subject.

The Principal Factors Influencing Stock Market Performance

Gross Domestic Product (GDP)

GDP is one of the most significant determinants of stock market performance. When GDP expands, companies witness increased sales and profitability, leading to higher stock prices. Conversely, a decline in GDP can negatively impact stock markets. Korea Financial News reports that the Korean stock market experiences notable fluctuations in line with GDP variations.

Interest Rates

Interest rates directly affect borrowing costs for both businesses and consumers, which subsequently impacts investment decisions and overall economic growth. Low-interest rates often stimulate borrowing, increasing business activities, and driving stock market performance. Korea Financial News provides detailed analysis on how interest rate changes influence the Korean stock market.

Inflation

Inflation erodes the purchasing power of consumers, affecting both businesses and the stock market. When inflation rises, consumers have less disposable income, leading to reduced spending and a potential slowdown in economic growth. Understanding the relationship between inflation and stock market performance is crucial to make informed investment decisions.

Frequently Asked Questions (FAQs)

1. How do macroeconomic factors impact stock market performance?

Macroeconomic factors such as GDP, interest rates, and inflation can significantly influence stock market performance. For example, a rise in GDP often indicates a healthy economy, leading to increased corporate profits and stock prices. On the other hand, adverse changes in interest rates can impact business activities and borrowing costs, ultimately influencing stock prices.

2. How does Korea Financial News analyze the impact of macroeconomic factors on the stock market?

Korea Financial News provides insightful analysis on how macroeconomic factors affect the Korean stock market. The publication examines historical data, economic indicators, and expert opinions to offer comprehensive perspectives on the relationship between macroeconomics and stock market performance.

3. Are there any specific macroeconomic factors unique to the Korean stock market?

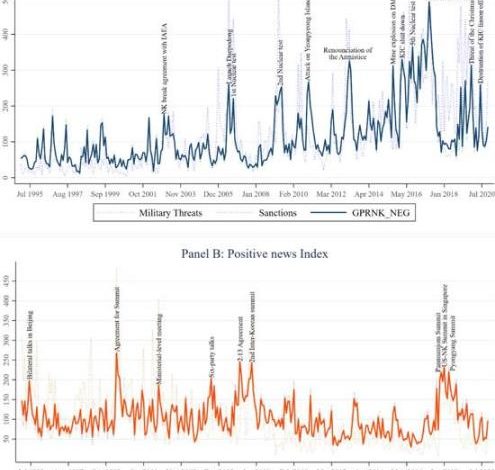

While many macroeconomic factors are universally applicable, some factors may have a more pronounced impact on the Korean stock market. For instance, political stability, geopolitical risks, and government policies specific to Korea can influence stock market performance. Korea Financial News explores these unique elements to provide a more accurate analysis.

Conclusion

Understanding the impact of macroeconomic factors on stock market performance is essential for investors looking to make informed decisions. Korea Financial News (Investment & Securities) offers valuable perspectives, analysis, and insights into this relationship specific to the Korean stock market. By staying informed about macroeconomic trends and their effects, investors can navigate the stock market with better confidence and increase their chances of success.

Whether you are a seasoned investor or just starting out, gaining knowledge about the relationship between macroeconomics and stock market performance is essential. Korea Financial News, with its reliable information, is a go-to resource for understanding this intricate connection.

Remember, always do thorough research and consult professional advice before making any investment decisions.