Top 10 Investment Strategies Every Investor Should Know

Top 10 Investment Strategies Every Investor Should Know

Investing can be intimidating, but with the right strategies in place, you can navigate the financial markets with confidence. Whether you’re a beginner or an experienced investor, it’s important to understand the various investment strategies available to you. In this blog post, we’ll discuss the top 10 investment strategies every investor should know.

1. Buy and Hold Strategy

The buy and hold strategy is one of the most popular long-term investment strategies. It involves purchasing stocks, bonds, or other assets and holding onto them for the long haul. This strategy assumes that the value of your investments will increase over time, allowing you to maximize your returns.

2. Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy that involves consistently investing a fixed amount of money in a particular asset at regular intervals, regardless of the asset’s price. This strategy helps to mitigate the impact of market volatility and allows investors to buy more shares when prices are low and fewer shares when prices are high.

3. Value Investing

Value investing involves identifying undervalued stocks or assets that have the potential to increase in value. Investors who follow this strategy analyze companies based on their fundamentals, such as earnings, assets, and growth potential, to find investments that are trading at a lower price than their intrinsic value.

4. Growth Investing

Growth investing focuses on investing in companies that are expected to grow at an above-average rate compared to the broader market. Investors who follow this strategy prioritize capital appreciation over dividends, focusing on companies that have strong growth prospects and innovative products or services.

5. Dividend Investing

Dividend investing involves investing in stocks that pay regular dividends to shareholders. This strategy is popular among income-focused investors who prioritize generating a steady stream of income from their investments. Dividend stocks are typically found in stable, mature companies that generate consistent cash flow.

6. Index Fund Investing

Index fund investing is a passive investment strategy that involves buying a portfolio of stocks or bonds that represent a particular market index, such as the S&P 500. This strategy aims to match the performance of the overall market rather than trying to beat it. Index funds are known for their low fees and broad diversification.

7. Asset Allocation

Asset allocation is a strategy that involves diversifying your investment portfolio across different asset classes, such as stocks, bonds, real estate, and commodities. This strategy helps spread risk and optimize returns by investing in a mix of assets with varying levels of risk and return potential.

8. Contrarian Investing

Contrarian investing is a strategy that involves going against the crowd and buying assets that are currently unpopular or out of favor. This strategy assumes that market sentiment can sometimes lead to mispricing, allowing contrarian investors to buy low and sell high.

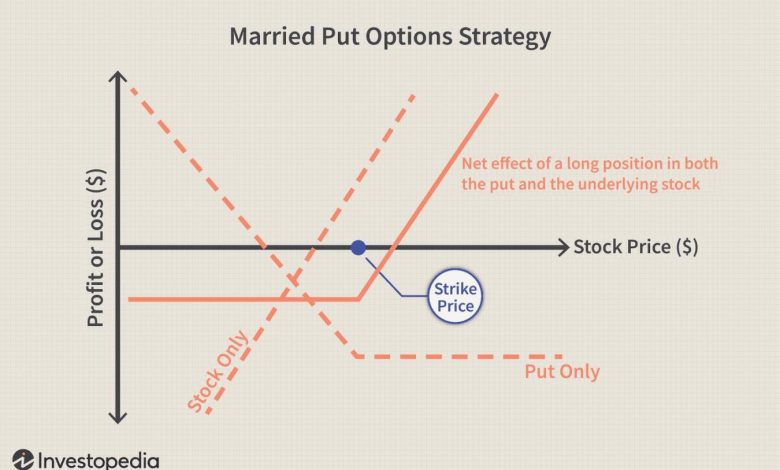

9. Options Trading

Options trading is a more advanced strategy that involves buying and selling options contracts to profit from market movements or manage risk. This strategy allows investors to take advantage of leverage and generate income through options premiums.

10. Real Estate Investing

Real estate investing involves purchasing properties with the goal of generating rental income or flipping them for a profit. This strategy provides diversification outside of traditional financial markets and can offer lucrative returns if done properly.

Frequently Asked Questions

1. Is investing in the stock market risky?

Investing in the stock market carries a certain level of risk. However, by diversifying your portfolio, investing in a mix of asset classes, and following sound investment strategies, you can manage and minimize the risks associated with investing in stocks.

2. How much should I invest?

The amount you should invest depends on your financial goals, risk tolerance, and investment strategy. It’s recommended to consult with a financial advisor to determine an appropriate investment amount based on your individual circumstances.

3. Can I invest with a small amount of money?

Yes, you can start investing with a small amount of money. Many online brokerage platforms offer low minimum investment requirements, allowing novice investors to start investing with as little as a few hundred dollars.

4. Should I invest for the short-term or long-term?

Investment strategies vary depending on your investment goals and time horizon. If you have long-term financial goals, such as retirement, it’s generally recommended to focus on long-term investments that provide consistent returns over time.

5. How often should I review my investment portfolio?

It’s a good idea to review your investment portfolio at least once a year to ensure it aligns with your financial goals and risk tolerance. However, in times of significant market fluctuations or life-changing events, it may be necessary to review your portfolio more frequently.

By understanding and implementing these top 10 investment strategies, you can increase your chances of building wealth and achieving your financial goals. Remember, investing involves risks, and it’s important to conduct thorough research or consult with a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered as financial advice. Always do your own research and consult with a financial advisor before making investment decisions.